XPP: XP Power

Things have been quiet on the blog lately because there hasn't been much actionable activity on my end. I've been looking into a lot of companies, but for the most part things seem fairly valued or overvalued.

Given the "temperature" of the market - the recent WSJ headline of "'Fear of Missing Out' Pushes Investors Towards Stocks sums up the lack of risk aversion nicely - I've tried to apply a stricter, more defensive qualification process for any investments, and have reduced my expectations for out-sized returns.

From this modest standpoint, and given the limited other opportunities that exist, XP Power (XPP.L - listed on the London Stock Exchange) seems attractive.

Overview

XP Power is a relatively small ($636MM market cap), niche business in an unexciting industry: power converters.

A power converter is an essential hardware component required in every piece of electrical equipment. The task of the component is to convert the relatively high voltage alternating current from the mains supply into stable low voltage direct current which is required by all electronic equipment. The power converter is also a safety critical component in any system as it protects the user of the equipment from the potentially lethal mains supply.

Their main customers are typically Original Equipment Manufacturers (OEM's) who make capital equipment.

Power converters are probably a product that most people haven't given much thought to, despite the fact that they are critical for almost everything we use.

Market

XP's customers are well diversified across a large set of geographies and industries:

Most notably, although "Industrial" is their largest segment, it is also the most fragmented, and "very few of [their] top 30 customers are industrial despite the fact it made up 43% of overall revenues."

Overall, they have 4,500 active customers, "with no one customer accounting for more than 14% of revenue." (They don't mention who that large customer is, but it is probably in Semifab, which has seen a large cyclical uplift in the past few years).

The power converter industry is highly fragmented, and they claim that "there is no single dominant player in the markets [they] address due to the diversity of customer requirements." The industry will likely continue to consolidate, and they still have a relatively small market share (2-12%) in key geographies and product lines:

Competition

There are a few established competitors (none of which are dominant), but the greatest threat to their business seems to be from "low cost Asian" competitors, whom they expect to be increasingly competitive in the European and North American markets. In particular:

Low cost Asian competitors continue to become more prevalent, particularly in the low power / low complexity end of the market. It is straightforward to source low cost/low power products directly from Asian manufacturers.

I emailed their Investor Relations department to ask what proportion of existing revenues were from these "low power / low complexity", potentially threatened market segments, and received this response:

We have highlighted the risk from low cost Chinese producers for many years. The situation has not changed. It is hard to precisely answer your question as there aren’t clear lines between the groups. The threat is more in the lower end which, as you highlight, is increasingly less important to our overall success. [Note: more on this below]

Given the ambiguous response, it's probably safe to assume that their exposure to this segment is still material, but this assumption should be taken in the following context:

They actually have been highlighting this risk for many years (I found mention of it in annual reports from 10+ years ago), yet revenues have still been increasing.

A key part of their strategy is in "moving up the value" chain - basically, more complex, collaboratively designed products.

The last point is an important one. XP's design / engineering teams typically work directly with customers to design the power converters into the end products. As equipment design increases in complexity, cost is less of a factor:

The equipment our products power is often mission-critical so quality and reliability are paramount. Cost, although important, is normally a secondary consideration for our customers

Increasingly, the design and manufacturing processes of major international Original Equipment Manufacturers takes place across different continents, with these blue-chip companies demanding global support.

It's also notable that, despite their warnings about Asian cost pressure, XP owns its own manufacturing facilities in both China and Vietnam, and they claim that their "Asian manufacturing bases in China and Vietnam are not only low cost but best-in-class", with labor costs in their newer Vietnam factories "significantly lower than those of our existing Chinese facility."

The only geography where they seem to be at a considerable cost disadvantage is in China:

Although Asia is a large market, much of it is not readily available to XP Power. Although XP Power has a factory in China the regulations require our product to be exported and re-imported into China. This means we are at a tax and duty disadvantage to local manufacturers who are generally competing on cost.

This is unfortunate, but not critical to their growth strategy.

Growth Prospects

Revenue

The company's historic growth rate is a little bit tricky to determine, because while most of their sales are in USD, they report in GBP. They have also made a few acquisitions recently, which I have attempted to exclude to determine a true "organic" growth rate:

https://docs.google.com/spreadsheets/d/1QnRLfofzOn9p5Ail58_B_4B6aYaxzRu1dyxG3gT7nXY/edit?usp=sharing ("Growth / Margins Worksheet" tab)

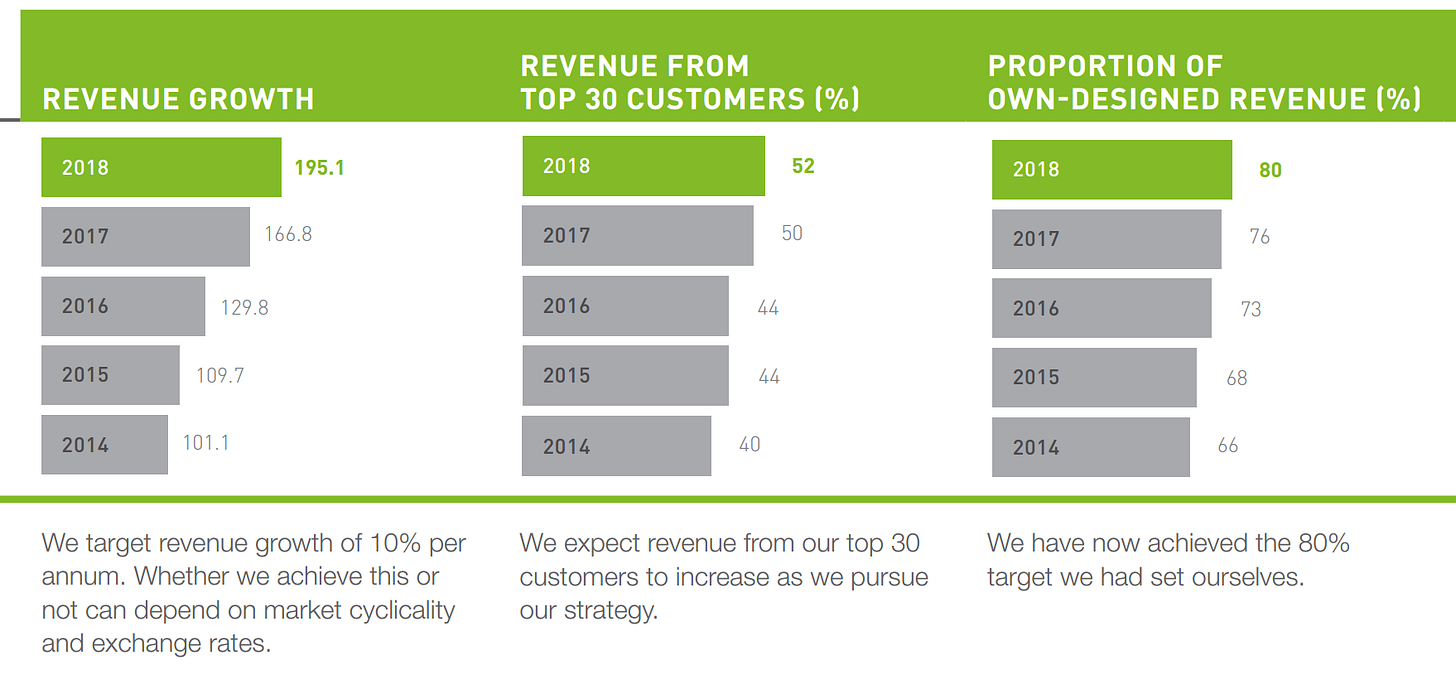

From these calculations, I arrive at a historic, organic, constant-currency adjusted growth rate of ~8-12%.

Looking at the broader industry as a whole, based on market size projections taken from XP's annual reports, the growth rate is ~7-8%. This is inline with various research reports that project the Semifab, Medical Imaging Equipment, and Industrial Equipment growth rates at 5-6% over the next decade.

I don't know how accurate these reports are, but combining everything together, a topline growth rate of 5-12% seems reasonable.

Operating Margins

Margins have been fairly steady at the 20% for the past decade. As mentioned above, they face cost pressures from lower cost manufacturers, but this threat is nothing new, and XP has been investing in new, cost-competitive manufacturing facilities in Vietnam (which enjoy lower costs than even China).

Recent acquisitions have increased their addressable market by 50%, so it's fair to ask if these businesses will enjoy similar margins.

Glassman Acquisition

In the fiscal year ended 31 December 2017, Glassman recorded sales in the US of US$17.3 million (£12.4 million), profit before tax of $2.9 million (£2.0 million) and had gross assets at the year end of $9.5 million (£6.8 million). Source

Which implies the EBIT margin likely greater than 16.7%.

Comdel Acquisition

In the fiscal year ended 31 December 2016, Comdel recorded sales of US$16.5 million (£13.0 million), profit before tax of $1.8 million (£1.4 million) and had gross assets at the year end of $10.9 million (£8.5 million). Source

Which implies an EBIT margin likely greater than 11%.

Making some really rough assumptions based on the margins of each segment and the core business weighted by revenue, and assuming that they aren't able to increase margins for these new businesses, overall margins for the entire company could drop by ~1%, closer to a long term range of 18-20%.

Strategy

XP's strategies to grow revenue and maintain margins have essentially remained unchanged over the past decade, and they seem to be executing well on them.

On the revenue side, they are focusing on greater penetration of key accounts for their top-30 customers. This appeals to their desire to move further up the value chain (more semi-custom designs, superior customer support, focus on quality not cost, ability to cross-sell products across their subsidiaries).

On the margin side, they have been increasing their sales from "in-house" designed and manufactured products. Again, this should allow them to maintain quality, add more value, and keep costs low because of greater utilization of their cost-efficient Vietnam manufacturing base.

Acquisitions will likely continue to play a larger role, and will need to be monitored.

Management

The management team is relatively young given that most of them have been with the company for nearly two decades:

The communication style of their Investor Relations site and annual reports is informative and straightforward. Their strategy is communicated clearly, and, as mentioned above, has been relatively consistent for the past decade.

They are also very transparent with the risks of their business, and publish a detailed description and ranking of threats to the business, as well as detailed steps they are taking to mitigate them. Rather than try to bury their risks in bland disclosure statements, they highlight them and discuss them in detail:

Incentives

The Long-Term Incentive Plan (LTIP) that the company provides to executives is refreshing in the sense that they don't attempt to lowball targets. Many companies set hurdle rates such that even if performance is "below average", executives still get rewarded.

In contrast to this practice, XP has realistic and what I would argue are more shareholder friendly goals:

No vesting of portion of LTIP shares if Adjusted EPS is below 6% annual compound growth (inline with their growth rate of the past decade, and also a higher threshold than the LTIP from 2017)

No vesting of portion of LTIP shares if Total Shareholder Return (TSR) vs FTSE 250 is below the median percentile. Only 25% of the award will vest if they perform at the median percentile (contrast this with Intel, which awarded executives 113.5% of a similar award in 2018, even though they merely performed at the median vs their peer group)

The Chairman and co-founder still owns 8% of the company, and the CEO owns £5MM of shares (and another £3.3MM in options), well above the £500k minimum holding for Executive Directors of the company.

Resiliency

At the start of this post, I stressed that I was looking for more "defensive" investments. The biggest part of that is not overpaying for a company, but another component is how resilient I think the company's business model is.

Although XP's revenue declined 17% during the "Great Recession" of 2009, they actually were able to slightly increase operating profit by increasing margins. In fact, they have increased operating profit every year (with the exception of 2012 - during the UK Austerity / Euro debt crisis) for the past 11 years.

While they are exposed to the cyclical capital equipment market, the segments (Semifab, Industrial, Healthcare, Technology) and geographies are varied. Furthermore, the long lived "annuity" streams from design wins can last for many years and may help smooth out the bumps:

Although they are listed on the London Stock Exchange, their headquarters are in Singapore, their manufacturing base is in Asia, and they do not expect to be impacted by Brexit:

In terms of the broader economic impacts of Brexit on our business, we do not consider that they will be material. Our products are made in Asia and are already imported into Europe where we have warehouses in both Germany and the United Kingdom and hence, we could ship our product destined for the European Union directly into Germany or another appropriate location. Plans are in place that will help minimise any logistical issues that arise following the United Kingdoms exit from the European Union.

Lower cost competition is always a threat, but management has proven that they have been able to execute well, and they seem to be having success moving up the value chain.

Valuation & Summary

A valuation model, based on the assumptions outlined above, can be found here:

(Feel free to make a copy and play around with your own assumptions)

XP Power isn't likely to be a 10-bagger, and it's not the most exciting stock to talk about at cocktail parties, but it has a lot of things going for it: moderately undervalued, niche business, growing market, diversified revenue streams, and a history of competent management whose incentives are aligned with shareholders.

In this market environment, you can't ask for much more.

Disclosure: I am long XPP.L