Diner Beware

One of my friends recently recommended a great interview with a relatively unknown European value investor named Anthony Deden. Deden is highly skeptical of management, financial reports, ratings agencies, governments and the press. He seems to operate under the premise that everyone is lying and likens investing to "going to a restaurant where everything on the menu is poisoned, but you're hungry."

Initially, I dismissed his assessment as overly paranoid. But after reading through another book, Financial Shenanigans by Howard Schilit, I'm beginning to come around to Deden's worldview. The book is an eye-opening account of how easy it is for companies to manipulate earnings using various accounting tricks, obscuring the true economic reality of the business.

Given that I have no background in accounting (other than some basic online courses), I had little hope of detecting any "shenanigans" on my own. So I was pleasantly surprised (and also disappointed) to discover a potential one, in an industry I understand well.

Accounting for Costs

Schilit describes accounting for costs and expenditures as a "two-step accounting dance":

Step 1 occurs at the time of the expenditure - when the cost has been paid, but the related benefit has not yet been received. At Step 1, the expenditure represents a future benefit to the company and is therefore recorded on the Balance Sheet as an asset. Step 2 happens when the benefit is received. At this point, the cost should be shifted from the Balance Sheet to the Income Statement and recorded as an expense.

Companies have a lot of discretion in realizing the benefit and expensing the cost in Step 2:

The nature of a cost and the timing of its related benefit dictate the length of time that this cost remains on the Balance Sheet. For example, expenditures to purchase or manufacture inventory remain on the Balance Sheet until the inventory is sold and revenue is recorded. On the other hand, expenditures to purchase equipment or a manufacturing facility provide a much longer-term benefit. These assets remain on the Balance Sheet for the duration of their useful lives, over which they gradually become expenses through depreciation or amortization.

Criteo (CRTO) Case Study

Criteo (CRTO) is an ad-tech company that has been facing a variety of headwinds in recent years, primarily related to privacy related concerns and regulations. This has resulted in anemic top-line growth recently, but operating profits have seemed resilient:

I believed that a lot of fears about the company were overblown, and the numbers seemed to support this case. There was some slight margin compression, but this made sense, as they were investing in new business lines and products in order to diversify away from their heavy concentration on ad-retargeting (90% of current business).

While reading through the the most recent Q2 2019 earnings call transcript, however, I noticed this line:

Depreciation and amortization expenses decreased 10% mainly driven by the change in the useful life of our servers from 3 to 5 years, represented approximately $10 million.

And digging into their 10-Q, I noticed this change in accounting policy, starting in 2019:

During the first quarter of 2019, we revised our estimate of the useful life of all servers and other equipment used in our data centers from 3 to 5 years. This change in estimate was determined based on a revised commissioning plan which extends the period equipment from 3 to 5 years prior to disposal. This resulted in an increase in income from operations of $21.0 million, increase in net income of $17.9 million, or $0.28 per share, from that which would have been reported had the previous expected useful life of 3 years been used for the six months period ended June 30, 2019.

So it seems like a large portion of their operating income so far this year ($21MM) has been driven by an accounting change: by "revising" the estimated useful life of their servers from 3 to 5 years, they are able to spread the cost of those servers over a longer period of time, resulting in a smaller current year expense. Schilit calls this type of move "Earnings Manipulation Shenanigan No. 4: Shifting current expenses to a later period."

If they had applied the same accounting estimates as 2018 to 2019, the results would have looked like this:

Still a profitable company, but a much larger deterioration in operating margins (-45.2% vs -9.1% YoY) than previously implied. These adjustments caused me to revise my long term targets down only slightly, but given that operating margins were already small, this resulted in a change from the company being an "obvious buy" to "probably fairly valued, but with some newly added management risk."

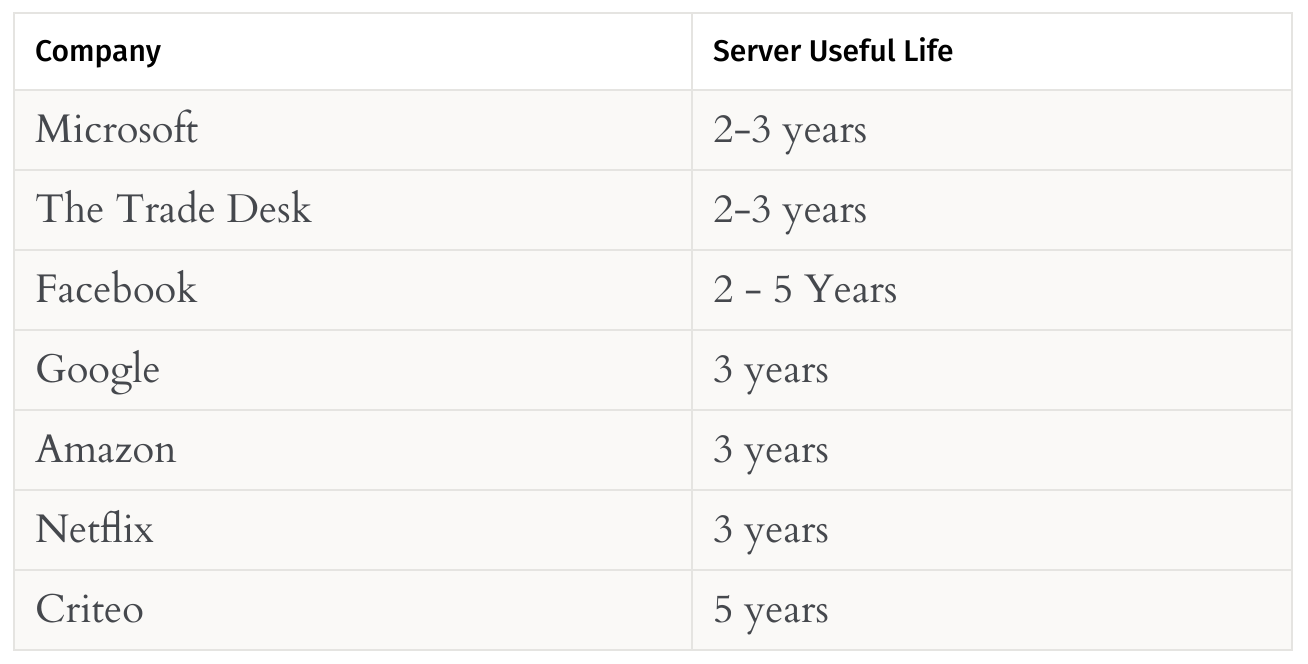

To be clear, this post isn't an accusation or indication that management is doing anything unethical. There may be good reasons for the change - perhaps they've figured out a way to optimize their existing servers. But the timing of the changes (during a period of increased existential scrutiny) is fairly suspicious, and their new "useful life" estimates appear at odds with other tech companies that I looked at:

Schilit also has some fairly strong, unequivocal warnings against this practice:

...if management decides to lengthen the amortization period, that should raise a loud warning signal...

...A company that chooses an overly long depreciation or amortization period generally would be considered guilty of using aggressive accounting. A more serious offense, however, is a company's changing to a longer period. This often suggests that the company's business may be in trouble and that it feels compelled to change accounting assumptions to camouflage the deterioration. Regardless of how management tries to justify such changes, investors should be wary...

... Healthy and confident companies are far less likely to tinker with these types of accounting assumptions that only provide optical benefits...

I don't have enough expertise to comment on whether or not the "food is poisoned" - in fact, I still believe they have a strong long term business model with plenty of cash on hand to weather any near-term struggles - but given the above, I've lost a bit of my appetite, and I think it makes sense to remain on the sidelines and continue monitoring for now.