In 2024, my portfolio returned 11.16% and the S&P 500 index returned 25.02%.

Cash holdings averaged 64.24% for the year.

Personal Performance vs. S&P 500 Index (with dividends reinvested)

Year Personal S&P 500

--------------------------------------------------------------

2018 30.36 (4.38)

2019 11.59 31.49

2020 17.15 18.40

2021 21.15 28.71

2022 5.78 (18.11)

2023 21.76 26.29

2024 11.16 25.02

--------------------------------------------------------------

Compounded Annual Gain 2018 - 2024 16.75% 13.84%Again, I’ll just repeat what I’ve written in the past two years, with some minor changes highlighted:

Results were far better than I expected going into the year, but my thoughts about general market conditions haven’t materially changed. The S&P 500 is

overvaluedprobably the most overvalued it has ever been.It continues to be challenging to find attractively priced companies with sufficient margins of safety. Many individual securities seem reasonably priced only if you assume record high operating margins and growth going forward. While not impossible, given the unusual conditions of the past few years, and the weight of the historical record, this doesn’t seem like a great bet.

Changes to the portfolio were minimal. Cash holdings remain high due to lack of attractive alternatives. I sold a few cheap Japanese companies and bought some other cheap ones with better growth prospects. Two recent new positions are Evolution AB (EVVTY) and Moderna (MRNA). Both have higher amounts of uncertainty, but also seem undervalued with some fairly conservative assumptions.

For example, MRNA recently traded at a ~$6.5B EV, but has spent nearly double that amount in R&D in the last three years alone. If you assign any value to that research, which seems reasonable considering that they have 43 drug development programs in their pipeline (including 25 in phase 2-3, many of which have multi-billion dollar TAMs), then downside seems limited. The COVID vaccine franchise still generates billions of dollars of annual revenue, and likely will still be necessary among higher risk populations. I don’t know what the exact value of MRNA is, but it is probably much larger than $6-8B.

Another way to look at it is as an “early stage” investment in a company with high optionality from the drug pipeline, but less risk, given the mRNA platform / technology have already been proven.

Costco

Costco is a good example of how expensive stocks have become.

Suppose you’re Elon Musk and you have a few hundred billion dollars to spare. A week ago, you could have bought the entirety of Costco for $440B (at ~$1,000 / share).

What kind of return could you expect on your investment over 10 years?

Costco is a pretty stable business, with remarkably consistent operating metrics over the past few decades, so let’s use the following assumptions:

Revenue growth 8% / year

Operating margin 3.5%

Effective tax rate 25%

(To keep things simple, let’s ignore reinvestment needs, although this has also typically run at about 0.5% of revenue / year)

So, over the course of the next 10 years, you might be able to pull out ~$80B on your original $440B investment, a total return of 18% or an annualized return of 1.6% / year, less than inflation.

Conversely, you could have just invested that money in a 10-year treasury bond, which currently yields 4.756% / year. Even without reinvestment you’d make ~$200B over 10 years, 2.5x the amount you would have earned in Costco.

The price of Costco stock would have to fall ~60% in order for you to match the same return you could get in a risk free treasury bond over the next 10 years. This seems absurd, but it is essentially the same valuation that Costco traded at pre-COVID.

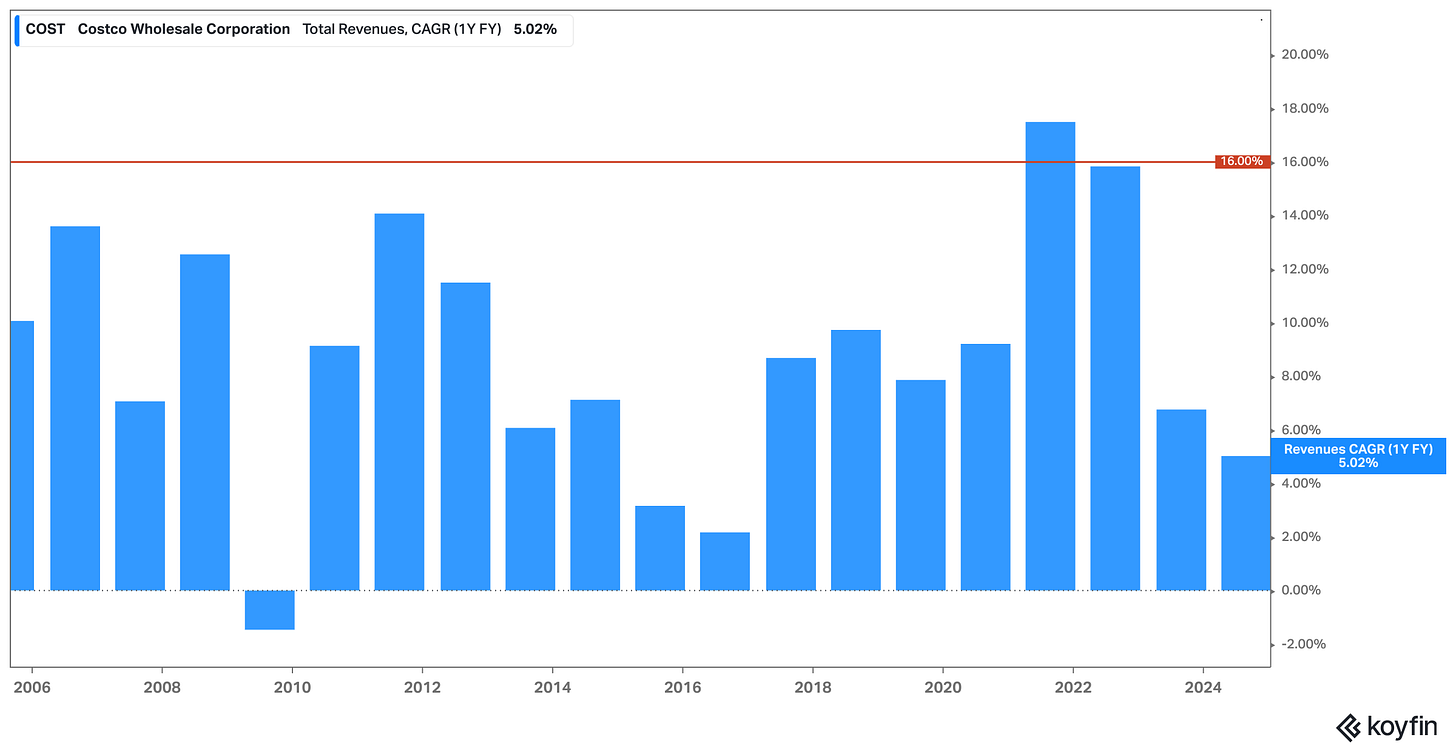

Another way to look at it is, how fast would Costco have to grow and what operating margins would be required merely to match the return on a risk free treasury bond over the next 10 years? It would have to grow revenue at 16% / year (2x the historical norm, despite being much larger now):

..and expand operating margins to 5% (significantly higher than anything that it has ever achieved):

These expectations don’t seem plausible. The expectations embedded in virtually every stock I’ve looked at this year, across a variety of countries and industries, seem similarly unrealistic.

Closing Thoughts

Costco is just one example, but qualitatively there are many other signs that we are in a bubble. Credit spreads are tight. Meme stocks have had a resurgence. Options trading among retail investors, most of which is indistinguishable from gambling, is at record highs. Fartcoin has a market cap of 1B.

Of course, that doesn’t mean a market crash is imminent. The US economy seems strong and it’s unclear what might derail it. If people are feeling good and have excess income to invest, then it hardly matters if they are willing to pay an exorbitant price for an asset vs a slightly more exorbitant price. And if people are willing to buy assets that have no intrinsic value (i.e. they will never conceivably generate any cash flow), then valuation hardly matters.

Much has been written about how AI is responsible for this year’s stock market boom. I’m a little more bullish on generative AI than I was earlier this year and it clearly has value. However, it’s still hard to see what the killer use case is (other than as an eventual replacement for vanilla Google search) that will justify the massive capex spend, especially when there is little practical differentiation between competing models.

I also asked multiple LLMs (Google Gemini, Claude AI, ChatGPT) some simple questions about taxes on investment income recently, and they all confidently made multiple, elementary errors - ignoring marginal tax brackets, using the wrong tax brackets altogether, ignoring filing status, ignoring the NIIT tax, ignoring the income thresholds for the NIIT tax, etc. This seems like a fairly well defined problem with few variables that should have been easily answerable, but the state of the art models failed completely. Although the answers sounded plausible on the surface, there seemed to be little “intelligence” at work.

Although there has been incredible progress over the past few years, it feels like the leap to something that is reliably useful in the agentic sense might take longer than expected, similar to the hype about reliable self-driving cars that were supposed to arrive years ago; 99% good is probably not good enough, and it might take a lot longer to close the gap to 100%, assuming it is even possible with current methods.

I’m continuing to look for opportunities on the margins, but they are getting harder and harder to find. Outside of small-caps in Japan, there is little that seems interesting. In general, I think extreme caution is warranted.

Current Portfolio

6460.JP (Sega Sammy)

FEVR.L (Fever-Tree Drinks)

2371.JP (Kakaku.com)

EVVTY (Evolution AB)

4432.JP (WingArc1st)

4071.JP (Plus Alpha Consulting)

3371.JP (Softcreate Holdings)

MRNA

Cash (72%)

I look forward to these updates as much as any hedge fund letter out there! Impressive performance given the high % of cash. A couple questions: 1) what do you do with your "cash" to maximize returns and what was your return on cash? and 2) How do you make position sizing decisions such that you end up with the high average cash balance despite the fact you've found opps that meet your criteria and obviously have performed very well? In other words, why don't you just keep you cash lower and your position sizes larger? You might also consider calculating your Sharpe ratio as a measure of risk-adjusted performance - I suspect it may tell a story even more impressive than your performance relative to the S&P. Thanks as always for the transparency and year-end report! I'll be looking closely at those names - especially MRNA.